This is because ideal debt to equity ratios will vary from one industry to another. For instance, in capital intensive industries like manufacturing, debt financing is almost always necessary to help a business grow and generate more profits. In such industries, a high debt to equity ratio is not a cause for concern. Despite being a good measure of a company’s financial health, debt to equity ratio has some limitations that affect its effectiveness. The simple formula for calculating debt to equity ratio is to divide a company’s total liabilities by its total equity. The difference, however, is that whereas debt to asset ratio compares a company’s debt to its total assets, debt to equity ratio compares a company’s liabilities to equity (assets less liabilities).

The D/E Ratio for Personal Finances

Assessing whether a D/E ratio is too high or low means viewing it in context, such as comparing to competitors, looking at industry averages, and analyzing cash flow. Like the D/E ratio, all other creating repeating invoices and bills in xero gearing ratios must be examined in the context of the company’s industry and competitors. Some analysts like to use a modified D/E ratio to calculate the figure using only long-term debt.

Personal Loans

All of our content is based on objective analysis, and the opinions are our own. This is helpful in analyzing a single company over a period of time and can be used when comparing similar companies. It is important to note that the D/E ratio is one of the ratios that should not be looked at in isolation but with other ratios and performance indicators to give a holistic view of the company. A good D/E ratio of one industry may be a bad ratio in another and vice versa. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

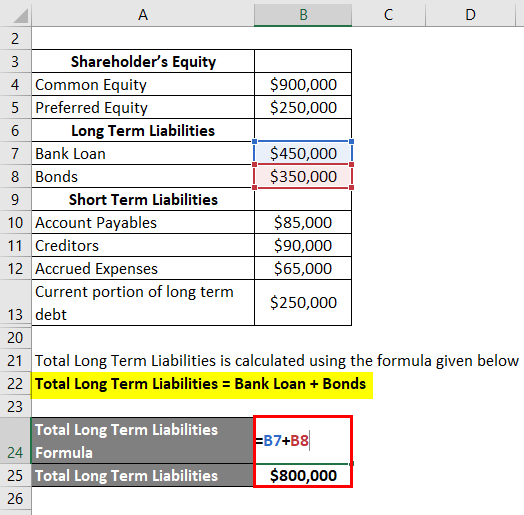

Debt to Equity Ratio Formula (D/E)

In general, if a company’s D/E ratio is too high, that signals that the company is at risk of financial distress (i.e. at risk of being unable to meet required debt obligations). The nature of the baking business is to take customer deposits, which are liabilities, on the company’s balance sheet. And, when analyzing a company’s debt, you would also want to consider how mature the debt is as well as cash flow relative to interest payment expenses. As an example, many nonfinancial corporate businesses have seen their D/E ratios rise in recent years because they’ve increased their debt considerably over the past decade. Over this period, their debt has increased from about $6.4 billion to $12.5 billion (2).

Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

Investors may become dissatisfied with the lack of investment or they may demand a share of that cash in the form of dividend payments. At first glance, this may seem good — after all, the company does not need to worry about paying creditors. Airlines, as well as oil and gas refinement companies, are also capital-intensive and also usually have high D/E ratios. One limitation of the D/E ratio is that the number does not provide a definitive assessment of a company. In other words, the ratio alone is not enough to assess the entire risk profile. These can include industry averages, the S&P 500 average, or the D/E ratio of a competitor.

Different industries vary in D/E ratios because some industries may have intensive capital compared to others. If the D/E ratio gets too high, managers may issue more equity or buy back some of the outstanding debt to reduce the ratio. Conversely, if the D/E ratio is too low, managers may issue more debt or repurchase equity to increase the ratio. This could lead to financial difficulties if the company’s earnings start to decline especially because it has less equity to cushion the blow. Generally, a D/E ratio of more than 1.0 suggests that a company has more debt than assets, while a D/E ratio of less than 1.0 means that a company has more assets than debt.

- The cash ratio is a useful indicator of the value of the firm under a worst-case scenario.

- Investors can use the debt-to-equity ratio to help determine potential risk before they buy a stock.

- For example, preferred stock is sometimes included as equity, but it has certain properties that can also make it seem a lot like debt.

- By contrast, higher D/E ratios imply the company’s operations depend more on debt capital – which means creditors have greater claims on the assets of the company in a liquidation scenario.

- In most cases, this would be considered a sign of high risk and an incentive to seek bankruptcy protection.

Inflation can erode the real value of debt, potentially making a company appear less leveraged than it actually is. It’s crucial to consider the economic environment when interpreting the ratio. Ultimately, the D/E ratio tells us about the company’s approach to balancing risk and reward.

A company with a higher ratio than its industry average, therefore, may have difficulty securing additional funding from either source. This ratio compares a company’s total liabilities to its shareholder equity. It is widely considered one of the most important corporate valuation metrics because it highlights a company’s dependence on borrowed funds and its ability to meet those financial obligations.

Typically, a D/E ratio greater than 2.0 indicates a risky scenario for an investor; however, this yardstick can vary by industry. Businesses that require large capital expenditures (CapEx), such as utility and manufacturing companies, may need to secure more loans than other companies. In 2023, following the collapse of several lenders, regulators proposed that banks with $100 billion or more in assets dramatically add to their capital cushions. These restrictions naturally limit the number of loans made because it is more difficult and more expensive for a bank to raise capital than it is to borrow funds. Higher capital requirements can reduce dividends or dilute share value if more shares are issued. This ratio looks at the level of consumer debt compared to disposable income and is used in economic analysis and by policymakers.